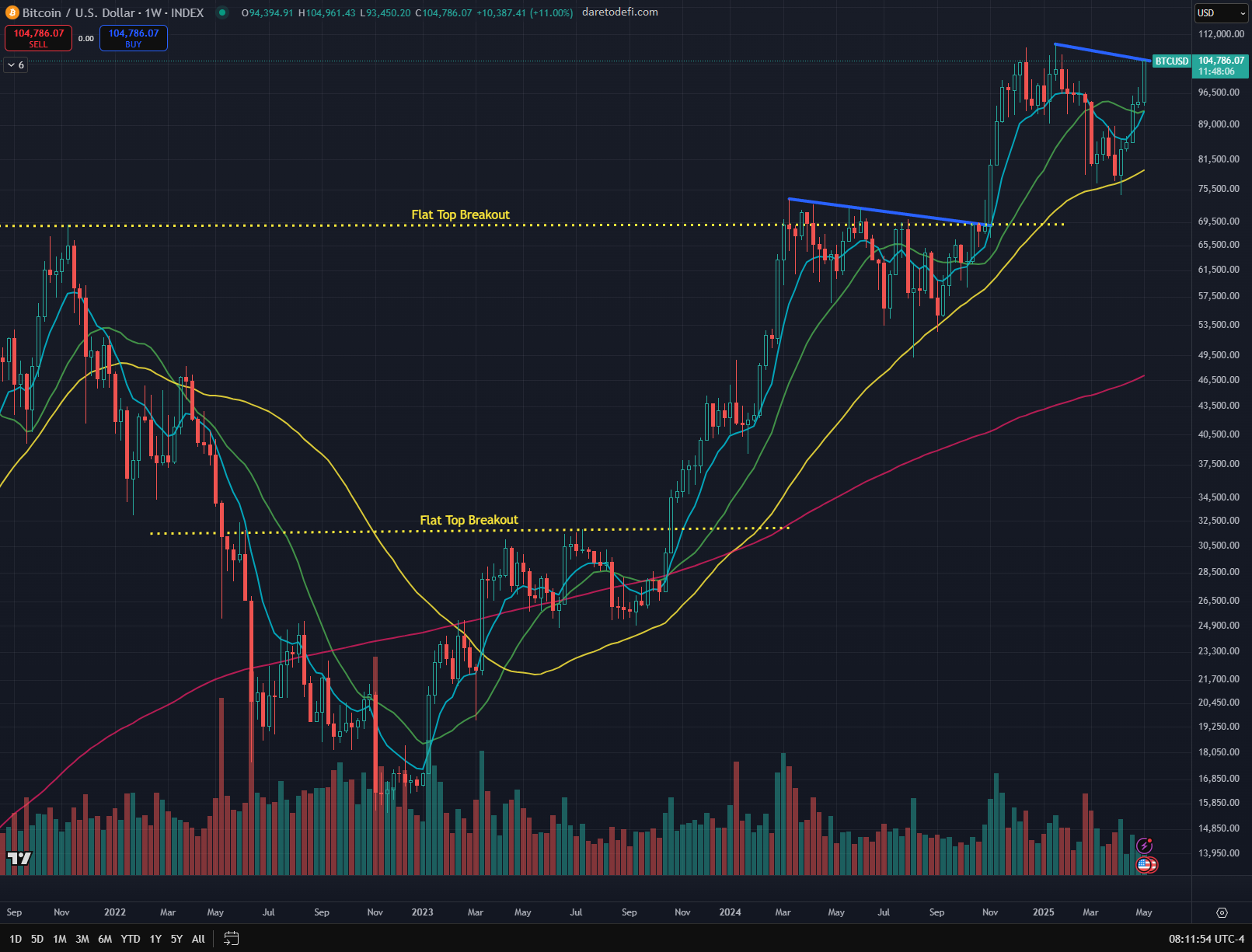

Stargate Log 005: Levels‑of‑Acceptance to 109k or 90k Pivot

ST‑Stargate Log 005: BTC punches 104k, eyeing 109k ATH. Flag flattens, rebound speed climbing. Levels‑of‑Acceptance: trim gains, reload on bounce, cut and run below. Watching previous price cross overs for full thrust. Half‑tank fuel reserve locked, and buckled up for the next burn.

Mission Statement

I, StrataTrader, chart DeFi’s galaxies under one creed: continuous evolution.

- Own Every Outcome, no blame, no excuses.

- Live Consistency, process over emotion, signal over noise.

- Pursue Infinity, test - reflect - refine, indefinitely.

Macro Terrain Overview

Field Note: Recent declines of roughly 30 % have rebounded faster, and the current flag slope is flatter than the last. This faster snap‑back suggests bulls are eager to exit into strength, raising odds of a blow‑off top if momentum persists.

Key Position Snapshot

- Core Long: 60 % size @ 89.7k cost basis

- Current Price: 104k

- Profit Ladder: Trim 2‑5 % chunks from 100 - 106k; larger tranches if > 109k

- Bull Zone: Daily closes ≥ 100k; brief 90k probes acceptable

- Bear Pivot: Daily close < 90k - exit longs, short rallies

- Technical Wishlist: Daily 50 SMA to cross above 200 SMA before heavy add

Income Edge: LP yields harvested; convert yield + partial principal to USDC at each trim level.

Responsibility, The Explorer’s Creed

Log Insight: Preparedness is self‑respect, set Levels of Acceptance (LoA) and Acceptance of Your Reality (AYR).

- Bear Capitulation LoA: 90k (Updated from Stargate Log 004)

- Action:

- Above 100k: partial profits, maintain core.

- 90 - 100k: watch reaction; add only with MA + volume confluence.

- < 90k: flatten, flip bias, hunt shorts.

Each trade is argued before the cosmic court: enter with evidence, hold while proof endures, exit the instant it fails = Acceptance of Your Reality = AYR.

Consistency, Lifeblood of Success

Log Insight: Taking profits along the way is critical to consistently being profitable.

Routine: Audit Your Market (AYM).

- Observe reactions at 100k / ATH.

- Update profit ladder & stops if levels break.

- Re‑run 5‑Whys on any impulse trade urge.

- Rule: Always skim a little on the way up, future is never guaranteed.

Continuous Improvement, Towards Infinity

- +1 % Upgrade: Added live on‑chain flow alert to spot whale exits.

- Metric: Pivot Latency (signal‑to‑action) now 86400 s (1 day) target < 60 s.

- Next Test: If 50 SMA > 200 SMA and volume spike, go full‑size with tight trailing stop.

Memory Hook: LoA + Latency + Ladder = L3 Edge.

Final Dispatch

I never launch on a full tank. Keeping half my fuel in reserve (for return), 50 % capital uncommitted this is my margin of safety. If a constellation is misread and the course veers off, that spare thrust lets me correct, refuel, and return. Fly fully loaded, miss the pattern, and the ship drifts past the point of no return.

A StrataTrader is defined by options: on the chart, in the wallet, and in life. Guard them, and the galaxy stays wide open.

Look high. Aim high. Fly high.

StrataTrader signing off: Stargate Log 005.