Star Gate Log 013: BTC Holding the Line - Risk Parameters Align at 105k, Structure Validates Entry

SG013: BTC holding the line at 105k, structure validates entry. Price held as MAs coiled and a higher low formed. FOMO emerged but was met with discipline. A risk-defined entry followed system logic. Emotional bias transmuted. Modest gain secured. Presence held. System refined. Trajectory: forward.

Weekly Journal of Strategic Execution and Skill Refinement.

Note: Apologies for the delay in publishing this log. It was postponed due to a loss in the family. Thank you for your patience and understanding.

Purpose: To navigate the DeFi frontier through disciplined risk management, strategic positioning, and reflective learning. This is the practice ground where conviction is tested, consistency is earned, and mastery is built.

🧭 Mission Statement

I, StrataTrader, explore the boundless DeFi frontier through disciplined experimentation and systematic reflection. Every trade is a test. Every log is a step. I accept full responsibility for my actions, commit to consistent execution, and evolve through perpetual feedback.

🌍 Macro Terrain Assessment

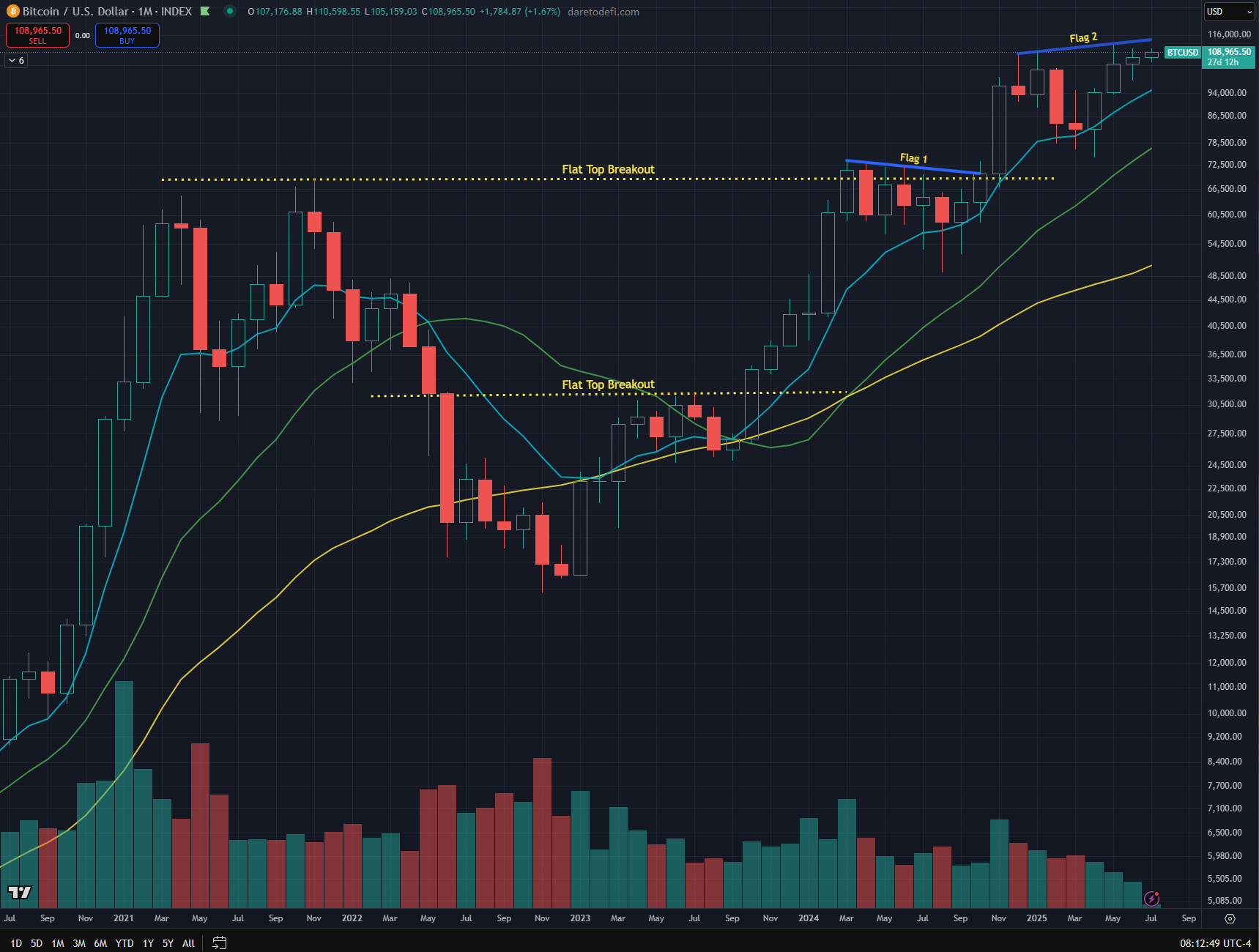

- This week BTC held support ~105k and is within the Gravitational Corridor i.e. trend. Holding above this region is showing signs of bullish strength.

- Key area for continuation appears to be ~112k resistance, possibly towards ~120k+.

⚖️ Levels of Acceptance

- Bull Zone (updated): Daily closes ≥ 100k; brief 105 to 96k probes (wicks) acceptable.

- Bear Pivot (updated): Daily close < 96k - exit longs, prepare downside playbook.

📊 Key Positions Snapshot

📡 Current Snapshot:

- Current Long: ~20% position size ~94k cost basis

- Increased position size from 15% to 20%, raising average cost to $94,250.

- Current price: ~108k

- In Profit: Yes

- Long Term Position 1 - 4:1 RR Target (not reached)

- Short Term Position 2 (new) - 2:1 RR Target (not reached)

- Fuel Reserve Ratio: Fuel Reserve Ratio - Full.

- Discussion in future Star Path log, possibly updating the Starship Enchiridion.

📝 Field Note: Execution Observations

The price action exhibited classic coiling behavior. Tightening within a narrow corridor, signaling potential energy buildup. A sharp rebound from the ~99k zone caught my attention, hinting at strong demand absorption. Since that move, BTC has consistently defended the ~105k level, reinforcing the foundation for a potential breakout. This compression + support dynamic was the key catalyst informing my trade.

My plan held in principle. I followed my rule and took a calculated risk with clear exit levels. By prioritizing risk control, I can make a directional bet to increase profits and the distance in my trek. Achievement unlocked, by limiting my risk exposure to a level I’m comfortable with. Just in case I’m wrong, I can regroup and recalibrate my system. Each trade like this brings me one step closer to unlocking the true edge: Consistency, my gateway to cosmic infinity.

Bias Identified: FOMO and regret aversion. Mid-flight, I felt it: the pull of FOMO. Anxiety rose, not just from being on the sidelines, but from the fear that others would capitalize while I watched. Beneath it sat a deeper force: regret aversion. Memories of moments I didn’t act when my gut signaled, but I hesitated and surfaced hard. That old voice returned: “See? You’re always right. Next time, just act.” But I’ve learned that impulse dressed as intuition can deceive. The real unlock was accountability.

Instead of reacting, I paused and returned to the system: tempo, logic, and risk structure.

- I reassessed my thesis using current market dynamics. BTC held strong above 105k, validating support. Momentum hinted at opportunity.

- I recalculated risk exposure, set my exits, and took the trade. Not from emotion, but from alignment. This wasn’t about being right. It was about being ready. I didn’t silence the fear; I translated it into awareness.

- Each cycle like this sharpens the system. Refining not just consistency, but the awareness to adjust early; before misalignment grows. That’s the edge.

🚧 Practice Debrief: Obstacles & Tensions

- Already positioned delta neutral, I considered a small bullish lean but hesitated. Doubt crept in: Was I buying into strength or chasing near a top?

- The shift to a bullish bias came when I observed price coiling and a clear higher low forming. That was the signal to ask a critical question: Can I quantify the risk relative to the potential reward? By anchoring to a 1 to 2% risk per trade, I translated uncertainty into a defined number I was comfortable losing. That clarity unlocked execution, allowing me to act decisively, not emotionally.

- I followed my playbook strategy, but not without internal conflict. I questioned whether the potential reward truly justified the risk. The structure was sound, but conviction wavered around value alignment: Was the risk I was taking worth the possible return?

💡 Core Insight - Star Path

Trust the Process - Every entry is a risk-to-reward equation. Each position isn't just a trade; it’s a test of my confidence in the system. What matters most: clarity in setup, conviction in process, and knowing exactly where to exit if I'm wrong.

🌱 Mental Model Germination

Seed: Calibration of Expectations - FOMO and regret aversion distort how we perceive results, calibrating expectations helps us stay grounded in planned outcomes.

- FOMO and regret aversion often distorts perception, inflating the need to capture the full move.

- Calibrating expectations means defining realistic risk to reward results. It’s about accepting modest gains without regret making scaling out a strategic action, not a compromise.

🔋 Responsibility (Fuel Reserve Protocol)

I honored my Fuel Reserve Ratio and LTV boundaries without compromise:

- 2.11

- 36.93%

🔁 Consistency (Execution Discipline)

- I entered a new position with clear R:R targets, without any regret.

- I followed my strategic plan and system logic throughout the week. Identified an opportunity, assessed the risks, and set modest levels for exit.

♾ Continuous Improvement (Towards Infinity)

+1% upgrade each log.

- 🎯Tactical Execution: Risk per trade capped at 1 - 2%, system integrity held.

- 🌡Emotional Calibration: This week, I overcame FOMO and regret aversion by entering a long BTC position, after defining clear risk to reward levels.

I adjusted my response to emotional triggers by anchoring the trade to technical support, placing stop levels accordingly. Knowing the exact amount, I was willing to lose gave me the confidence to remain patient and let myself breathe without any interference.

Progress isn’t in the outcome; it’s in the discipline of execution.

🛰️ Final Dispatch

Mission executed and signal recorded. System integrity held under pressure, though doubt surfaced mid-flight. Risk was defined and clarity restored.

Art is not in prediction or perfection. It’s in presence. See the opportunity. Assess the risk. Let the levels come to you.

That is the way.

That is the ceremony.

That is how we move, step by step, toward infinity.

“When the levels arrive, take a modest amount.

No more, no less than the moment offers.

If the moment has passed, do not chase.

If it has not yet come, do not yearn.

Wait, watch, and remain ready.

The edge is not earned through prediction or perfection.

It’s forged in presence with measured action and modest gain.

Be disciplined to take only what the system gives.”Epictetus Evolved (EE),

Teachings from the Edge of Infinity

Note: I’ll be entering a month-long retreat to recalibrate body, mind, and spirit. Star Gate Logs will shift to ad hoc transmissions until I return to active navigation on August 8, 2025. Thank you for your patience as I realign systems for the next phase.

StrataTrader signing off Star Gate Log 013.