Star Gate Log 004: Levels of Acceptance Strategy - Trim , Reload , & Cut

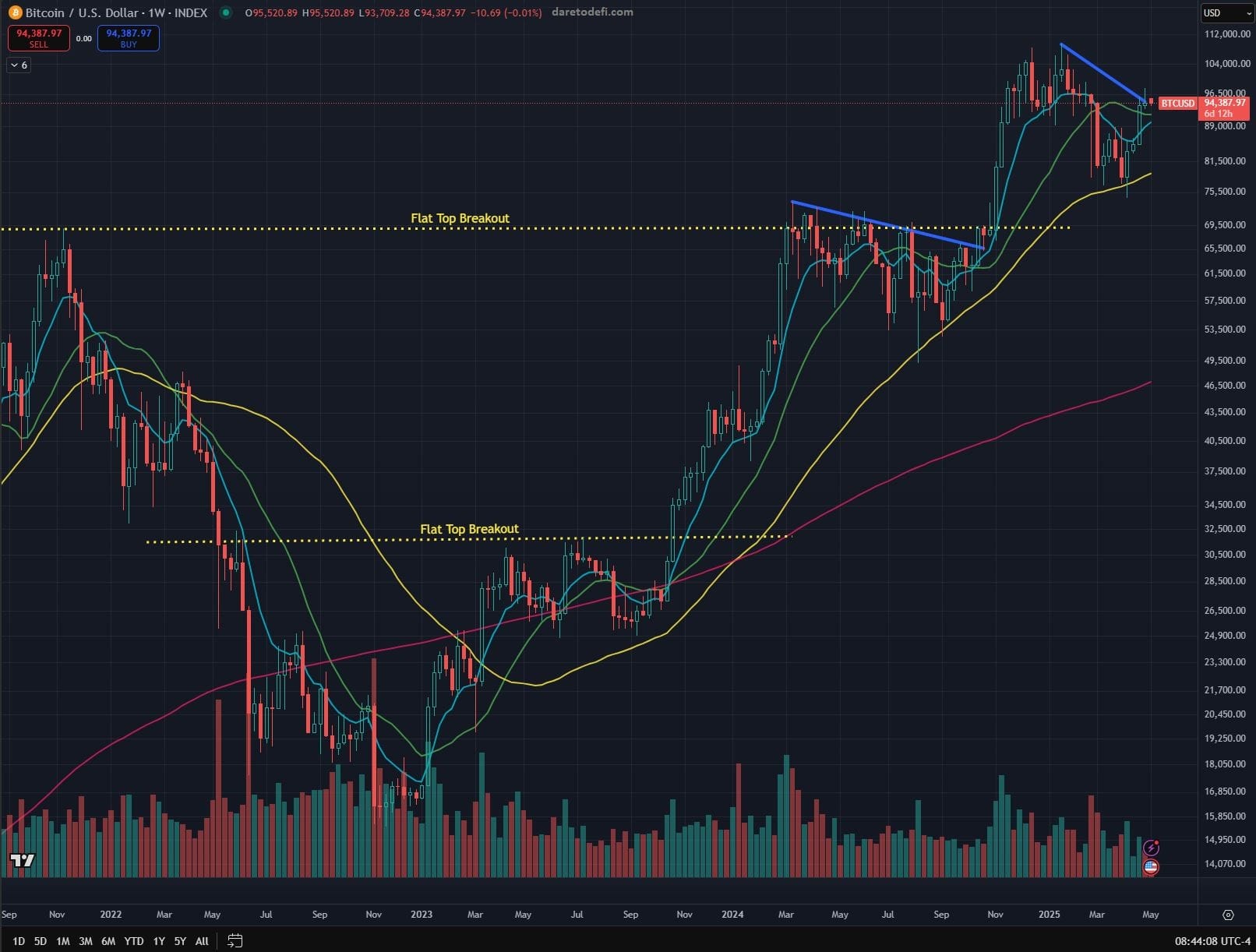

SG004: Bitcoin technical briefing, holding support. Some fail levels to watch. Levels of Acceptance Strategy: trim position scale out, reload on healthy bounce, breach below: cut and run. FOMC volatility ahead, buckle up and set stops. Ladder set, ready for takeoff.

Mission Statement

I, StrataTrader, voyage the DeFi cosmos under one unwavering creed: continuous evolution. Like a star‑ship captain charting unknown sectors, I navigate markets by:

- Owning every outcome : zero blame, zero excuses.

- Living consistency : a calm, rule‑driven process above market noise.

- Pursuing Infinity : an endless loop of trial, feedback, and refinement.

Macro Terrain Overview

Field Note: The next gate to reach is 99 - 101 k. Expect turbulence there; decisive strength or a hard pullback will set the tone forward.

Key Position Snapshot

- Bull Zone: Above 91 k, brief probes to 88 k allowed.

- Bear Pivot: Break of 86 k = bias flips short.

- Plan:

- > 109 k: Trail stops, de‑risk above ATH (~109 k).

- < 86 k: Exit longs; prepare downside playbook.

- Neutral 86 - 101 k: Wait for 9/20/50/200 MAs & volume to align.

Responsibility, The Core of the Mission

Log Insight: Mental readiness = knowing my Levels of Acceptance: the exact P/L thresholds that trigger action.

Levels of Acceptance - Checklist

- Euphoric Breakout

- Trigger: Close ≥ 109 k (prior ATH)

- Action:

- Scale‑out 20 % as price nears 109 k

- Above 109 k: set trailing stop on remaining 80 % and ride momentum toward 130 – 145 k

- Healthy Pullback

- Trigger: Intraday tests to 88 k that closes ≥ 91 k

- Action:

- Add to position (up to target size)

- Hard stop just below 88 k

- Keep existing profit‑ladder for upside

- Momentum Crack

- Trigger: Daily close < 91 k or 9 EMA crosses below 50 SMA

- Action:

- Flatten 50 % of longs

- Tighten stops on the rest

- Stand by for Bear Capitulation or new base

- Bear Capitulation

- Trigger: High‑volume flush into 86 k to 75 k zone

- Action:

- Exit all remaining longs if still open

- Begin bottom‑fishing: scale‑in 15 % per Fib band (78.6 %, 61.8 %, etc.) only after a capitulation wick closes back above 80 k

- Memory Anchor:

- Euphoric - Scale Out

- Healthy PullBack - Add

- Momentum Crack - Guard

- Bear Capitulation - Reset

Consistency, The Lifeblood of Success

Log Insight: Price tells its truth at key levels - stall, slice, or spring.

Routine: Each week I audit those reactions.

- Note how price behaves at 88 k, 91 k, 101 k, 109 k.

- If levels hold, keep current profit/stop loss plan.

- If levels break, rewrite the plan and targets.

Rule: No plan = no trade.

Result: Weekly reviews hard‑wire discipline and keep risk‑to‑reward in my favor.

Continuous Improvement - Toward Infinity

- Mantra: No perfection, only +1 % upgrades each log.

- Action:

- Scale‑out 5 - 10 % between 94 - 99 k

- Increase tranches once 109 k breaks.

- Focus: Daily LoA check - anchors emotions and fortifies discipline.

- Patience: Observe like a hunter; conserve strength until the signal arrives.

- Execution:

- Stars aligned = strike with full intent.

- No alignment = stand down.

Final Dispatch

True preparedness begins with self‑respect: defining my Levels of Acceptance and honoring them without hesitation. Each trade is a case I argue before the cosmic court - enter only with evidence, hold while the proof endures, exit the moment it fails.

Momentum, when confirmed, is a warm tail‑wind across the hull - felt, measured, then ridden. Never pursued.

My mission at DareToDeFi.com is the same each cycle: study the heavens like an ancient navigator, align the constellations of price and volume, then ignite the thrusters. I launch only when risk is fully embraced, for that is how a wolf of the stars discovers how far he can truly roam.

Look high, aim high, fly high.

StrataTrader signing off: Stargate Log 004.

“Be the wolf on the ridge - silent, reading every gust. Guard your strength while the herd drifts below. When the true opening appears, strike without hesitation; if the wind turns, fade into the forest without regret. Such is the wisdom of the patient hunter.” Epictetus Evolved.