Pulse Log 017: From Intuition to Measurable Metrics - Portfolio Dashboard Upgrade Resume.

PL017: From intuition to measurable metrics, the portfolio dashboard upgrade transforms gut feeling into data-driven clarity. Progress is no longer guessed; it’s quantified. System upgrade complete v14.

Sharing a track from my playlist, had this on repeat. Volume at 20%, just enough to let the rhythm carry the reflection.

Call Sign: System.Upgrade-Measurable-Metrics

System Cycle: 2025.Q4

Duration: ~60+ days

System Upgrade(s): Tracking: Performance, Equity Curve, and Growth.

Opening Signal: Why I Left 🌱

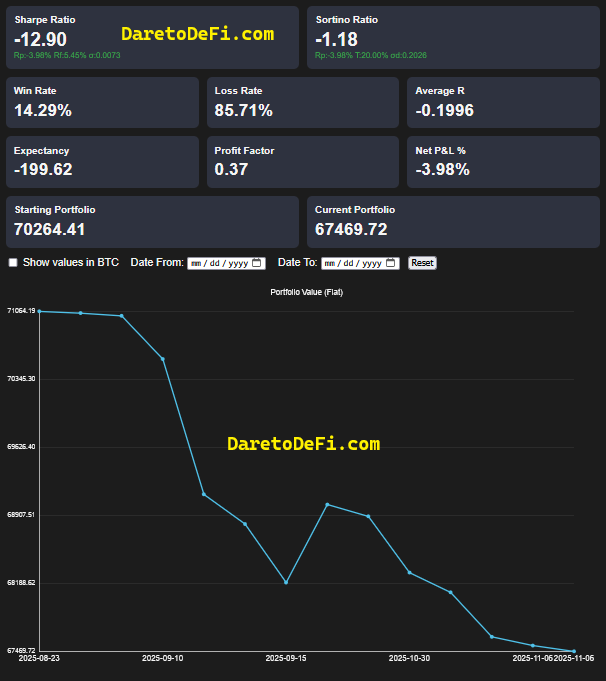

I needed to improve measurement and tracking progress. I wasn’t happy with 18.85% positive returns; I wanted to improve my system (i.e. Starship) for higher results. So, I reset the portfolio back to ~70k in search of improvements to investigate, searching for the root of my results. Aiming to identify patterns that emerged.

My decision to leave was rooted in diminishing returns and a disconnect between win rate and growth. I have been operating on ego, expecting that past performance is indicative of future results. Which is farthest from the truth. In this time away I felt a moment of clarity in my purpose and found inspiration through creativity. Stillness resulted in a re-alignment of myself with my values.

Results that are managed by P&L are usually diminishing returns, but results managed by improving behavioral mistakes are ones that can be continuously improved. Narrowing the gap between stated goals and the real outcome is the key for improving results.

Field Notes: What I Saw, Felt, Faced 🌀

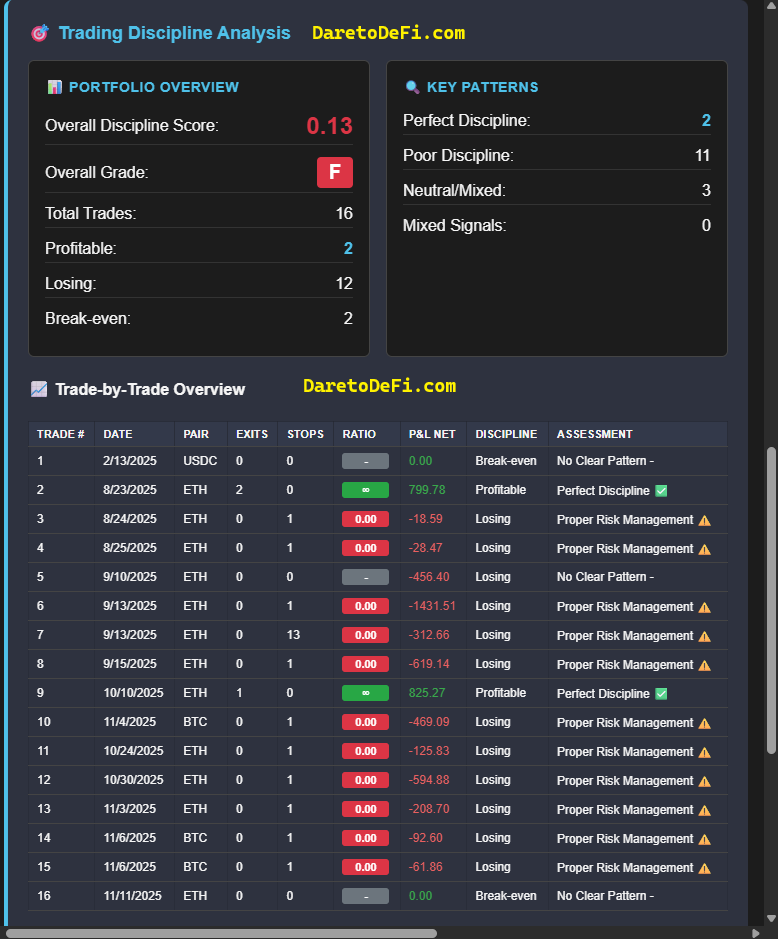

My greatest revelation during this upgrade, surprised me. If I was to grade myself, I’d get an F.

All the strategy and rules in the world aren’t enough, unless I know how much I followed them. Tracking progress by knowing how far off track I am (my variance) and identifying behavioral patterns is key.

It’s understanding where I currently am, versus where I need to be. But the first few updates of the upgrade surprised me.

Trade Discipline log

After reviewing the Trade Discipline log: 16 total, 2 were profitable, 2 were break-even, and 12 had losing results.

Discipline review showed a common theme of issues with weak risk management and alignment with the trend. With high risk of emotional decision-making overriding planned strategy. Scoring each trade enabled me to visualize the variance (static) of my results. The process of examining each entry and exit through my stated strategy opened my eyes to my real results.

Identifying serious flaws in my entry and exit criteria, required behavioral changes to review and strengthen conviction in trade management.

Diving deeper in reflection, I decided to journal every entry to understand the quality of my results.

Trade Journal log

Reviewing the trade journal of 16 trades, current avg. score of 1.22, and quality rate of 6% is very low. Opportunity to significantly improve.

Being patient and selective based on my criteria is key to my results. By increasing the quality of my entry positions: aligning direction with confluence, I only enter travel which tracks my growth. High probability entries are those which are in the direction of the trend. Entry levels must align with daily and hourly timeframes, and directional confluence with momentum oscillations: oversold or overbought.

By increasing the quality rate of my entry positions, I will only take positions which align with these requirements. These increase positions will improve my sample size and increase the statistical reliability of my results (quality rate).

Breakthrough Logic: What Clicked 🧩

Out of Sight, Out of Mind is a powerful model upgrade in my system. Just as my father would say, “Monkey see, monkey do!” Which casts a subtle message that if you see your results, you can improve them.

I wasted too much time trying to perfect each trade, by overcomplicating my entry and exits. Resulting in analysis paralysis, and often ended up chasing with FOMO, when my original assessment proved correct. It’s the psychology of someone who hasn’t accepted that taking losses is part of the system. But never taking too much loss, it risks my entire portfolio on any trade travel.

Improving trade quality by aligning directional entries with momentum sentiment (overbought or oversold) can have a positive effect. Through improving quality, I expect my R:R results to improve; win rate and increase net results.

No matter how performance is tracked, if I don’t track my results, I can’t sustain progress. Echoing the mental model upgrade: Out of Sight, Out of Mind.

Portfolio Dashboard

The upgraded Portfolio Dashboard is my compass of navigating my direction forward: Top of Sight, Top of Mind.

System Upgrade ⚙️

- Upgrade Name: Portfolio Dashboard - Top of Sight, Top of Mind.

- Old Pattern: Managing my performance results based on P&L is sufficient portfolio management.

- Root Cause Found: Results that are managed by P&L usually have diminishing returns, because they offer little to no insight into the drivers of performance. To improve consistency of results, I need to understand the process and where I’m going wrong.

- New Protocol: Portfolio management requires monitoring progress with a visual dashboard. Enabling the review of key metrics at portfolio (starship) level view, down to every trade: entry and exit. Which measures current progress and identifies possible areas for improvement. Providing insights into behavioral drivers and mistakes which can be modified and improved.

- Testing Plan:

- Test: Journal each trade setup, entry and exit review.

- Track: Increase quality of entries with directional bias and confluence with momentum sentiment.

- Measure: Evaluate win rate, risk-to-reward ratios, and portfolio growth to assess the impact of this new approach.

- Expected Impact: Improve Win Rate, Expectancy, Profit Factor, Net P&L %.

- Goal: Consistently increase Current Portfolio value greater than Starting Portfolio.

Thread of Continuity 🧬

This upgrade strengthened my system.

By reinforcing key performance metrics and advancing my commitment to growth. The upgrade resolves a long-standing gap in measuring progress, now fully implemented and operational. This upgrade deepens my understanding of the current system by making progress measurable and transparent.

This insight aligns with the broader narrative of building effective and adaptive management systems.

Returning Mindset 🛸

Journaling every trade transforms each action into a data point - revealing patterns, guiding adjustments, and driving growth.

I will reinforce the habit of reviewing the trade journal, after every trade. Ensuring consistent reflection, progress tracking, and disciplined system feedback. I recognize that perceptions are often emotional fabrications, not reflections of real results. Grounding my perspective in data preserves clarity under pressure and looming volatility. This insight grounds decisions in measurable truth, and metrics reveal what emotions hide.

Every action can now be tracked, monitored, and refined through visible results.

Final Transmission 🛰️

Tracking measurable progress gives you coordinates of where you are.

It’s about seeing the forest you’re in, beyond the trees. Clarity emerges from measuring perspective. But, consistent portfolio growth depends on the speed at which we identify and resolve issues. Transform effective management systems that quantify progress. Using metrics, not emotions; to guide your next action.

Dashboards anchor focus, discipline, and alignment in real time. A visual reminder of what’s important.

“Navigation through unknown constellations and galaxies is an art, which is in your control. Data is the compass of your actions, self-reflection is asking why, but daily practice is consistency like rockets. Blasting you forward, in the direction of your eyes.”

Epictetus Evolved - EE

StrataTrader signing off, Pulse Log 017: From Intuition to Measurable Metrics - Portfolio Dashboard Upgrade Resume.